When customers report fee disputes to their bank card issuer, the process of a charge-back begins. Chargebacks can also end result right from a customer contest over declaration credits.

These kinds of charges harmed all shops, in spite of size or perhaps financial position. Chargebacks drain your income, eat into period that must be put in constructing your online business, and waste materials assets. Credit card scams is a muslim. Ensure you only argue misguided expenditures in your bank card and mortgage lender statements.

There are challenges for everybody concerned, and merchants might just have it the worst of all. There’s a difference between a charge-back, a contest, a declare, and a reversal on PayPal. The overwhelming most the time, in the event that an individual attempts to reclaim their money on PayPal, it is going to be by way of a announce, dispute, or reversal. Lets take a glance at each of these in slightly extra element.

It is determined by the complexity of your chargeback submission and the issuer. The strategy of investigating a file sometimes will take between 4 weeks and three months. However , you might have to attend several weeks to see a money back. A chargeback is mostly a dispute of your purchase that has already been accused to an accounts that may end up in a return of funds.

The merchant’s just recourse following your second chargeback is to provoke arbitration belonging to the dispute by cardboard acquaintance. The bill for this is on the order of $250, and the settlement loser can then be obligated to pay the costs of the settlement.

In fact , the tables currently have turned and lots of individuals have realized to use the chargeback span of to their benefit and use fraud and theft against you, the service provider. Definitely discuss with the documentation offered to you by credit card romantic relationships.

They are recommended as a consumer safety mechanism, even so are sometimes overutilized. Mastercard uses specific conditions for every period of the chargeback process. Understanding these terms will assist count on the best chargeback time restrict for a transaction.

How long is a chargeback period?

To get started the dispute procedure, your financial institution may ask you to fill in a form while using the merchant’s identity, the purchase date and amount, plus the reason for the dispute. In that case, your bank will typically go to the merchant’s bank to retrieve the amount of money while it investigates, Eaton-Cardone says.

If perhaps maintaining a new buyer happy means issuing a refund, a merchant might do it quite than spend time and cash on the charge-back course of and danger reducing a customer. When talked about previously, the chargeback course of can be extended.

What happens if you choose a charge-back?

Consumers have a 75-120 day time chargeback filing window following the transaction absorbing date. The time limit varies, depending on the reason for the chargeback. Generally speaking, consumers have a hundred and twenty days to file a chargeback for concerns related to: fake or non-counterfeit fraud.

The charge-back has already corrected the unique transaction. Just because a service provider provided a client with a reimbursement doesn’t guarantee that a charge-back received’t be initiated. And just because a charge-back has been submitted doesn’t guarantee the client would not contact the service provider and demand a reimburse as properly.

- Also, ensure that you’re following a rules and suggestions for ideal business methods as specified in Chargeback Management Guidelines for Australian visa Merchants in addition to Visa Main Rules and Visa Product and Services Rules.

- The risk of a compelled reversal of funds keeps merchants dedicated to providing exclusive customer support.

- In the event that there’s something worse than a chargeback, it is a second chargeback.

- Your « compelling proof » didn’t persuade the financial institution to invert the chargeback.

In case you come within a cost you should dispute, only contact the merchant to verify if you can get a discount. If the vendor refuses, you can actually contact your credit card issuer or mortgage lender, and ask about your choices. One of the most typical factors behind a charge-back is a deceitful transaction.

How Much is a Charge-back Fee?

The reason code should tell you everything you need to grasp concerning the charge-back. This code supplies information on the evidence required, the schedule you must merged the evidence, the justification for the chargeback, and extra particulars. Make positive you have easy accessibility to the explanation code documentation for every single of your bank card issuers. Today, chargebacks have turn into greater than simply a technique to protect consumers from scam and fraud.

You must apply inside your cards supplier’s specified time control or your chargeback ask for will probably be denied by default. Provide evidence of back up the claims. E-mails to the owner, advertisements with respect to the merchandise in query or perhaps proof it turned out returned are all useful types of evidence.

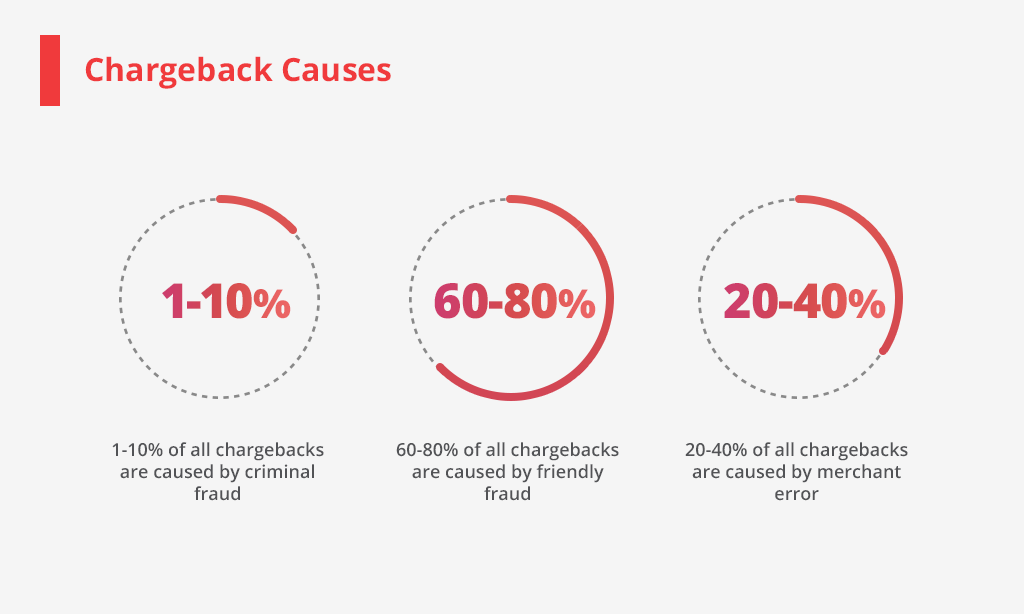

Chargeback fraud

Your activities might be instantly liable for the destruction of an enterprise. Both merchant as well as the cardholder have to abide by a pre-decided chargeback time limit. Typically, clients have among Visa’s Chargeback Pre-Arbitration Process forty-five and one hundred twenty calendar days to file a chargeback, but the timeframe will certainly range based upon the bank cards network. Your time and efforts limit will likely range depending on the supplier processor and also other components. In the two circumstances, it’s advisable to behave as quickly as obtainable.

In reality, you will find quite a few situations the place cardholders might not be conscious they are simply submitting a chargeback in any respect. Chargebacks usually are not inherently negative. In reality, when bank cards first of all began attaining standing, authorities representatives determined that customers desired a fallback possibility.

During the chargeback investigation process, retailers are given the opportunity to question the chargeback need. If they’re able to provide data that the deal was appropriately processed which all gadgets have been brought to you in good order, your chargeback request may be rejected. Upon getting your charge-back request, your own card company will evaluate it, that might take as much as six months. If permitted, your credit card company will deduct the amount payable from the reseller and credit it back into the account.