Financial accounting

This means posting transactions to the general ledger and to the proper accounts. This work is typically handled by a bookkeeper—not an accountant. Accounts payable is defined as the money your business owes creditors or suppliers and is considered a liability. This liability is recorded on your company’s balance sheet (more on that below).

With this let us prepare the Income Statement for the four case studies above. In the case of revenue, we saw the accrual concept of accounting (revenue is recognized when it is earned). Likewise, for expenses, the actual date of payment doesn’t matter; It is important to note when the work was done. In this case study, the parcels were delivered (work completed) in the month of December . Money was not received in the month of December, “receivables will be recorded” as assets for the month of December.

As these items are sold to customers, the inventory account will lower. Sir can you please explain us what is the difference between “statement” , balance “sheet” and “account”. in cash basis accounting income are recorded when it is actually received and expenditure are recorded when it is actually paid.

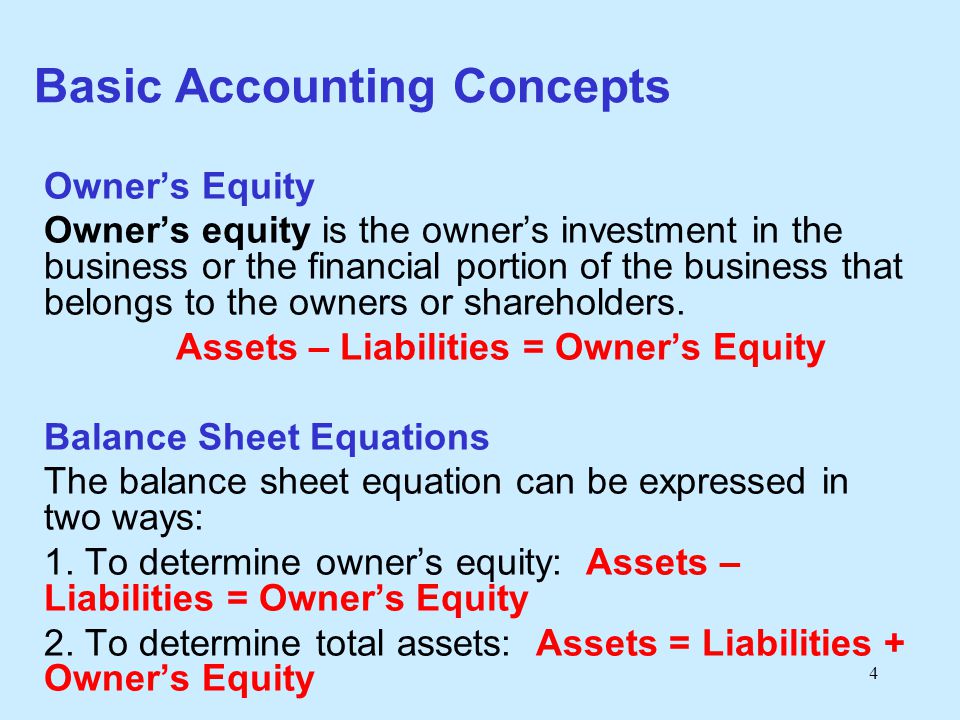

If you subtract your assets from your liabilities, you’re left with your business’ equity. Commonly confused, the terms bookkeeping and accounting do not mean the same thing. Bookkeeping is the act of recording transactions properly in a business’ accounting file.

The Big Four and many other large public accounting firms develop accounting software for themselves and for clients. The accounting cycle refers to the process of generating financial statements, beginning with a business transaction and ending with the preparation of the report. (Figure) shows the six steps in the accounting cycle. The first step in the cycle is to analyze the data collected from many sources. All transactions that have a financial impact on the firm—sales, payments to employees and suppliers, interest and tax payments, purchases of inventory, and the like—must be documented.

Things like rent and payroll would be considered operating expenses. Cost of Goods Sold, or COGS, is made up of the expenses required to create your business product or service. Things like the cost of your product’s materials or the labor required to provide https://www.bookstime.com/ your service are COGS. Generally Accepted Accounting Principles, or GAAP, are a set of guidelines and rules that govern how businesses handle their accounting. It’s worth noting that the United States is one of the few countries to follow GAAP.

Managerial accounting helps management teams make business decisions, while cost accounting helps business owners decide how much a product should cost. Regardless of the size of a business, accounting is a necessary function for decision making, cost planning, and measurement of economic performance measurement. Accounting is one of the key functions for almost any business.

Fixed assets (non-current) may provide benefits to a company for more than one year—for example, land and machinery. These principles, which serve as the rules for accounting for financial transactions and preparing financial statements, are known as the “Generally Accepted Accounting Principles,” or GAAP.

Cash Basis Accounting – A method where income and expenses are recorded only with the payment of cash to the business or from the business. Though not the best method for accurate records, it’s a simple practice suitable for small businesses with mainly cash transactions.

Finding the right accounting solution for you

As a business owner, you’ll likely be doing a bit of both. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. Closing journal entries are made https://www.bookstime.com/articles/opening-entry at year-end to prepare temporary or nominal accounts for the next accounting period. The amounts of nominal accounts in one period should be closed or brought to zero so that they won’t be mixed with those of the next period.

- All changes are summarized on the “bottom line” as net income, often reported as “net loss” when income is less than zero.

- This liability is recorded on your company’s balance sheet (more on that below).

- Balance Sheet to gives an idea of what the company owns (ASSETS) and owes (LIABLITIES), as we as amount invested by the Shareholders at a specific point in time.

- His banker recommends Marilyn, an accountant who has helped many of the bank’s small business customers.

- This means posting transactions to the general ledger and to the proper accounts.

- Loans are also considered a liability.

Credit

Depending on the account type, a debit or credit will either increase or decrease the money in the account. It is important Balancing off Accounts to remember that whenever there is a journal entry, the debits in the entry must always equal the credits in the entry.

The term refers to the difference between accounts payable and receivable. Late paying customers are the leading reason companies experience cash flow issues. This document indicates your company’s financial performance for a reporting period, which is typically annually or monthly. Once, the trade liability is paid, we see a cash outflow to suppliers in the cash flow statement.

Now you have 💲20,000 in assets—your 💲10,000 in cash and the 💲10,000 loan proceeds from the bank. The bank loan is also recorded as a liability of 💲10,000 because it’s a debt you must repay.

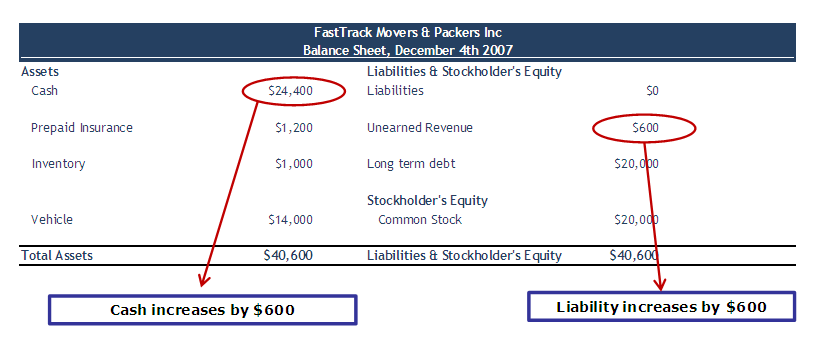

All of these are perceived to be good for stockholder value. Shareholder’s Equity –The third section of a balance sheet is Stockholders’ Equity. (If the company is a sole proprietorship, it is referred to as Owner’s Equity.) The amount of Shareholder Equity is exactly the difference between the asset amounts and the liability amounts.

By getting into the habit of entering all of the day’s business transactions into his computer, Joe will be rewarded with fast and easy access to the specific information he will need to make sound business decisions. Marilyn tells Joe that accounting’s “transaction approach” is useful, reliable, and informative. She has worked with other small business owners who think it is enough to simply “know” their company made $30,000 during the year (based only on the fact that it owns $30,000 more than it did on January 1).

They arise from present obligations of a particular entity to transfer assets or provide services to other entities in future as a result of past transaction or events. For example, Kartik took loan from the Bank. This loan is basically a liability which Kartik needs to pay in future.

Monetary Unit Principle – Business transactions that are recognized as monetary currency are only recorded in a business’s accounting records. Cost Principle – A business should record its fixed short and long-term assets at original cost and not fair value at the time of acquisition minus accumulated depreciation. Accounting Period Principle – A business should report the results of its operations over a standard period of time, typically monthly, quarterly or annually in order to make useful comparisons. We also increased our Sales Revenue, but since it is an income account we would need to record it on the Credit side (right side). Accounting is setting up a system of recording and summarizing financial transactions in such a way that they can later be analyzed or used to communicate with others.

The Income Statement (often referred to as a Profit and Loss, or P&L) is the financial statement that shows the revenues, expenses, and profits over a given time period. Revenue earned is shown at the top of the report and various costs (expenses) are subtracted from it until all costs are accounted for; the result being Net Income. Depreciation is the term that accounts for the loss of value in an asset over time. Generally, an asset has to have substantial value in order to warrant depreciating it. Common assets to be depreciated are automobiles and equipment.